Our Financial Planning Process

BluePages

We created the BluePages over 7 years ago to help our clients make the smartest financial decisions. So many are surprised how easy it is to understand their financial situation after the BluePages experience.

The Client Dashboard

This was developed after three decades of working with clients.

Those that had the highest probability of success focused on five important metrics. Your dashboard helps you know when something is working or not working.

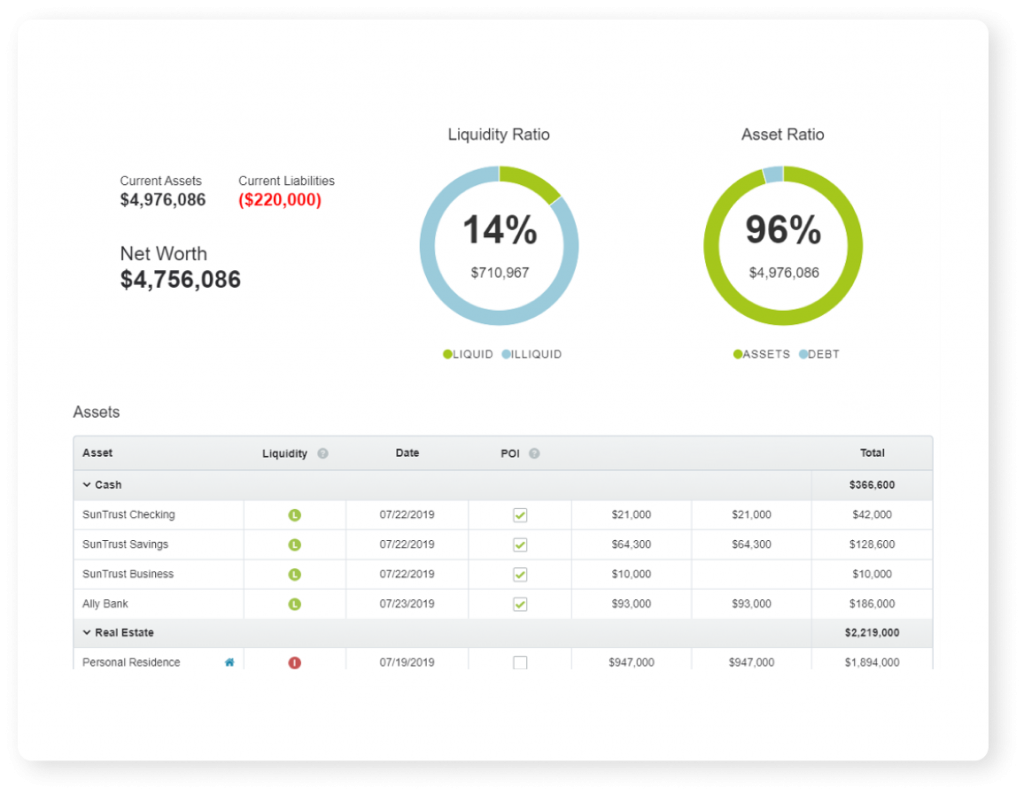

Statement of Net Worth

The snapshot of your wealth today begins the journey.

The toolkit for success is found on this page. Opportunity and hardship share a similar theme—the need for capital. Your financial flexibility is tested here.

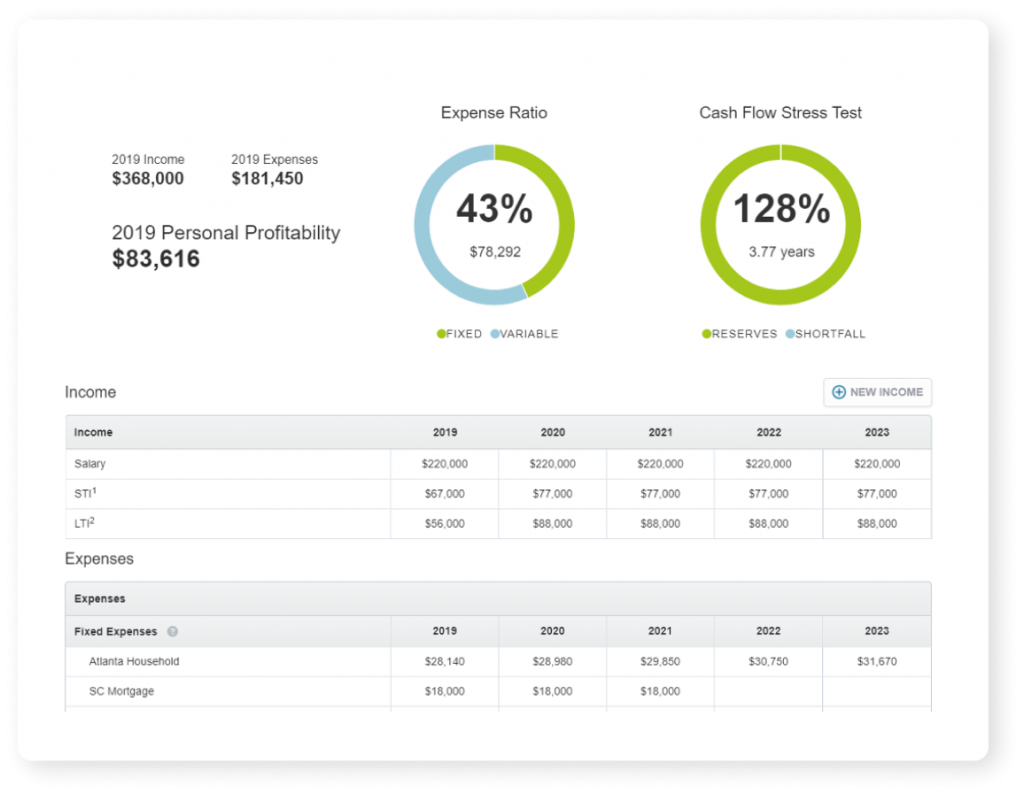

Statement of Cash Flow

Your life revolves around how you earn and spend money. Those that Make Work Optional focus their energy here.

The goal of this page is to help you track:

- Changes in cash flow over the next 5 years

- Flexibility of your Family Overhead

- Target savings rate to achieve your Point of Independence (POI)

- And, safety net in case the unthinkable happens