Warren Buffett’s Simple Investing Principles

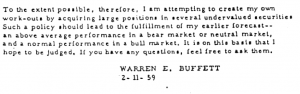

Being in Omaha, Nebraska the weekend that Warren Buffett published his annual letter to shareholders was a great moment to spend time reading some of his older letters. All are online, at the Berkshire Hathaway website, which is a testament in itself to his ‘no frills‘ culture. The letters on the website go back to 1977, but in other places we can read back all the way to 1959, letters he wrote for his original Buffett LTD Partnership. An early excerpt is below:

In each letter, Buffett exposes his thinking on investing. He discusses why he invests in certain companies, not in others, and why all of his investments follow some very simple rules. In his latest letter, he shares a story of a farm he purchased at the height of the banking crisis in the 80’s in Nebraska, when banks failed in numbers that made the Great Recession seem minor.

Rule #1: If you don’t understand it – don’t invest in it.

He did a quick back of the napkin calculation of the projected income and expenses; he figured it would earn about 10% per year. He stated, “I needed no unusual knowledge or intelligence to conclude this investment had no downside and potentially substantially upside.” Buffett has always stuck with this motto. He has been criticized for it, especially during the Internet bubble. His rationale is simple: if he can’t understand how a company makes money and will be making money ten, twenty or fifty years from now – he doesn’t consider it a viable investment. Utilities, insurance or ketchup; there will be a need for all of them for decades to come – and Buffett likes it that way.

Rule #2: Crisis creates opportunity

His opportunity to buy the Nebraska farm for $280,000 (a price substantially lower than the FDIC showed owed on the books) happened because of a banking crisis and he had the cash to take advantage of the opportunity. When an opportunity is not available, don’t force one. For most investors he states, “liquidity is transformed from the unqualified benefit it should be, to a curse.” This simple statement exposes the most critical flaw in the foundation of the current financial planning model. Cash is viewed as failure of effort by financial advisors; for Buffett, it represents a metric of success. You cannot predict when the next opportunity will arrive, and missing an opportunity because you don’t have cash is the same as losing money.

Rule #3 Investing is very different from speculating.

If you are setting the foundation of your success based on a future price, you are speculating not investing. Watching a stock everyday is both meaningless and mind numbing. Buffet notes on his recent acquisition of Heinz and NV Energy: “Both companies fit us well and will be prospering a century from now. Berkshire never intends to sell a share of the company.” Investing is about buying profitable assets at a good price that deliver a recurring income stream. Buying and selling does not build value; owning a long term profitable business creates long term sustainable wealth.

The 1986 financial crisis created the opportunity for Buffett to purchase the farm at a substantial discount. Everyone else was selling; he was buying. He calculated a minimum unlevered return of 10% for both properties. While the upside is nice, it was not required to achieve meaningful results. The investment returned positive cash flow in the form of rent from day one. The cash flow kept coming rain or shine and it didn’t require much effort because he had reliable people helping him manage the property. Simple is good.