Surgeon Decides Not To Operate on Self

We are all faster and more creative when addressing someone else’s problem than when we’re addressing our own. This is why even the greatest surgeon doesn’t operate on himself. Read the short puzzle below and try to figure out how the prisoner escaped.

A prisoner desperately wants to escape. One day he discovers a rope in his cell. Trouble is, the rope is only half the length necessary to allow him to reach the ground safely. Yet he divides the rope in half, ties the two parts together, and escapes to his freedom.

This riddle was posed to 137 graduate students by Evan Polman of NYU and Kyle Emich of Cornell University. They asked half the students to think like they were the prisoner and the other half was asked to think like someone else was the prisoner. Fewer than 50% solved the riddle if they thought of themselves as the prisoner while more than 66% solved the problem if someone else was the prisoner. We are better when working on someone else’s problem than we are when working on our own issues. We just can’t see our own issues with the clarity and vision that someone else can. For the New Year, my number one suggestion is stop doing it yourself. No matter how simple, I think it is critical to outsource financial planning and investment management. The emotions of proper investing are not natural instincts. This coupled with our “me” bias often leads to less than stellar results. Each year DALBAR produces the Quantitative Analysis of Investor Behavior (QAIB). The quote from their website below is telling:

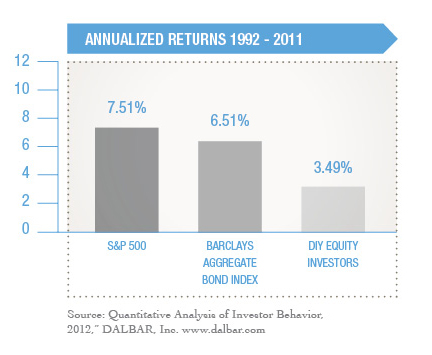

After conducting this year’s Quantitative Analysis of Investor Behavior (QAIB), Dalbar found that in 2011, the average equity fund investor underperformed the S&P 500 by 7.85%. The poor performance shows that psychological factors continue to harm the average investor and the remedies for these behaviors remain a work in progress.

The chart below shows the performance of the Do-It-Yourself (DIY) investor for the last twenty years.  Unfortunately, the DIY model of investing usually leads to tragically poor results. The average DIY investor uses the rope to tie a noose rather than finding freedom. Increase the odds of achieving your Point of Independence; make it a new year’s priority to hire a very good financial planner.

Unfortunately, the DIY model of investing usually leads to tragically poor results. The average DIY investor uses the rope to tie a noose rather than finding freedom. Increase the odds of achieving your Point of Independence; make it a new year’s priority to hire a very good financial planner.