Sir Isaac Newton: Brilliant Physicist. Miserable Investor.

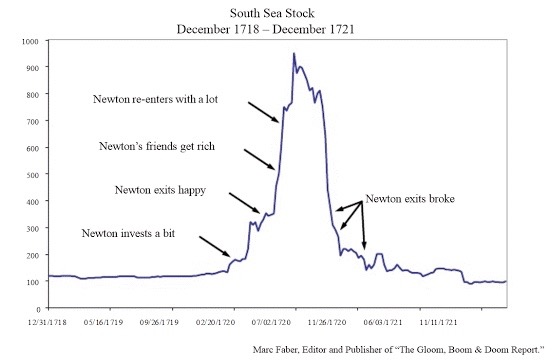

At Holcombe Financial’s recent client learning event about “Behavioral Biases and Their Investment Limitations”, my favorite story was about Sir Isaac Newton’s early investment success and subsequent failure during the South Sea Bubble. In 1720 Newton profited handsomely, earning £20,000 by the time he sold his shares (big bucks in those days). Sounds like an expert move, right? But Newton had a problem – the market continued to rise while he sat on the sidelines with cash. The “lost gain” from sitting in cash got the best of him, and Newton re-entered the market. Unfortunately, this time Newton lost everything when the South Sea bubble popped. Nothing on earth could have saved him from the emotional anxiety of watching other people get rich.

We all suffer from the inability to make rational decisions when it comes to investing. Our brains are just not wired to think that way. In his book Thinking, Fast and Slow, Daniel Kahneman talks about how to handle these known failures in the way we think:

“The best we can do is a compromise: learn to recognize situations in which mistakes are likely and try harder to avoid significant mistakes when stakes are high.”

Kahneman is asking us to understand that we are predestined to make mistakes because of the way our brains are wired. But just like we have glasses to correct our sight, wheelchairs to help those that cannot walk, and elevators to help carry us to reach unimaginable heights, we can build the right support to help us manage these predictable situations.

The balance between the fear of loss and the fear of lost gain is the emotional tight rope every investor walks when making an asset allocation decision. In our meetings with clients, we simulate outcomes using dollars instead of percentages because that is the only way to make the scenario feel real. “With this portfolio, a 30% decline in the market would result in a $600,000 loss.” Or “this conservative portfolio would not enjoy a $250,000 gain if the market increases 30%” These types of simulations are critical to help make the best financial decisions for our family and ensure that each and every one of us should only have to get rich once.

If you’re interested in finding the right asset allocation for you, call us at 404.257.3317 to start the path to your Point of Independence.